Author: Steven Jones, editor of Moneyweb’s Tax Breaks

13 February 2013 06:59 Provisional tax: Claim your medical tax credit

"How to ensure that your medical tax credit is taken into account when completing your provisional tax return.

QUESTION:

Being a provisional taxpayer and with the 28/02 deadline approaching, I am not sure whether or not to include the credit in my estimate for taxable income, or ignore it, i.e. should I deduct the amount I arrive at from taxable income or not ? SARS of course auto completes the line for rebates in efiling, so unless they make provision in their efiling IRP6 form for a new line specifically for medical credits claimed, I assume that my taxable income estimate should take account of the medical credit calculated as per those over 65 years ?

ANSWER:

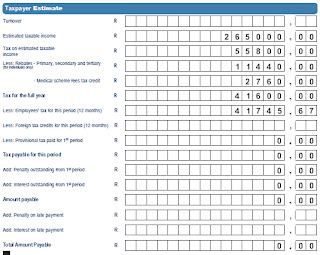

The new IPR6 form on e-filing incorporates a provision for the medical tax credit. Once you have entered your estimated taxable income, the system calculates the tax liability as well as the primary / secondary / tertiary rebates based on your age as at the end of February 2013.

In the next line immediately below the rebates is a space for you to enter the tax credit. This you need to calculate manually as follows:

R230 per month for the taxpayer

R230 per month for the first dependent

R154 for each additional dependent

In the example below, the taxpayer is a single member with no dependents, therefore the medical tax credit is R2 760 (R230 x 12).

Finally, as was the case in previous years, enter any employees' tax deducted and provisional tax paid, and the system then calculates what you owe SARS. If your employees' / provisional tax exceeds the tax liability, the amount payable will be nil. In terms of the new SARS rules, if there is no liability you are not required to submit an IRP6, but seeing as you have got this far, it makes no difference if you click "file" other than the fact that having filed the return may give you peace of mind.

Don't forget to keep a copy of your workings, in case you need to prove to SARS that your estimate was reasonable and within the parameters stipulated."

If you have any queries please contact me.

Best Regards

Steven

Steven Morris CA (SA)

Mobie : 083 943 1858

Fax: 086 671 2498

E-Mail: steven@global.co.za

Website: www.stevenmorris.co.za

Excellent write-up about provisional tax claims. I definitely need need this resource in the my study. Thank you.

ReplyDelete