Chartered Accountant providing updates in Accounting and what is going on in the Financial Markets around the world> !!

Friday, 22 November 2013

Glencore Xstrata Plays The Africa Card As It Size Up Anglo American

Hi All Just read a great story !!

href="http://www.forbes.com/sites/timtreadgold/2013/11/21/glencore-xstrata-plays-the-africa-card-as-it-size-up-anglo-american/">erican/

Enjoy Kind Regards

Steven

Steven Morris CA (SA)

Mobile: 083 943 1858 Fax: 086 671 2498

E-Mail: steven@global.co.za

Website: www.stevenmorris.co.za

Sunday, 31 March 2013

Cypriots scramble to get money off island

REF FT/com

The hunt is on for many Cypriots to find ways to circumnavigate the new Draconian capital controls and get their money off the island. At least three people have attempted to flee the island in recent weeks with more than €200,000 in cash on their person, according to official sources.

Kind Regards

Steven

Steven Morris CA (SA)

Mobile: 083 943 1858

Fax: 086 671 2498

E-Mail: steven@global.co.za

Website: www.stevenmorris.co.za

Monday, 18 March 2013

Wednesday, 6 March 2013

ScentAir South Africa- BDM / Sales & Marketing Mgr

Allsense Southern Africa Trading (Pty) Ltd

A client of mine is expanding business nationally in South Africa

(I get not commision or fee for this)

They are hiring a new BDM / Sales and Marketing Manager for our South African biz.

Either full time or a consultant on a project / part time basis.

Based in Gauteng South Africa.

Do you know anyone with sales/client management experience ideally with contacts in retail, hospitality,

agency looking for their next big opportunity?

If so pls drop me their details and I will fwd on.

More info on the company on the website – www.scentair.co.za / www.scentair.com

Best Regards

Steven

Steven Morris CA (SA)

Mobile: 083 943 1858

Fax: 086 671 2498

E-Mail: steven@global.co.za

Website: www.stevenmorris.co.za

Wednesday, 27 February 2013

South African National Budget Alert:

Sanlam National Budget Alert:

New income tax calculator is now available -

http://m.sanlam.co.za/tax-calculator?name=steve&number=%2B27839431858

New income tax calculator is now available -

http://m.sanlam.co.za/tax-calculator?name=steve&number=%2B27839431858

BRIEF SA BUDGET SUMMARY

BRIEF BUDGET SUMMARY

REF : SPI

"The budget and your wallet:

· Personal income tax relief of R7 billion. The marginal tax rate remains 40% and is applicable to an taxable income of more than R638 000 per annum.

· Sin taxes: A packet of 20 cigarettes will cost 60c more, a 750 ml bottle of liquor (spirits) R3.60 more, a 340 ml can of beer 7.5c more and a 340 ml can of cider will cost 7.3c more. A 750 ml bottle of wine will cost 15c more.

· The national fuel levy to increase by 22.5c/l and the Road Accident Fund Levy by 8c/l . The tax on fuel will therefore increase by 30.5c/l.

· Tax treatment of contributions to pension, retirement annuity and provident funds to be harmonised.

· Phased implementation of carbon tax proposed. It will be implemented from 1 January 2015 and amount to R120 per ton of CO2

· New PAYE proposals for individuals with more than one source of income.

· No increase in VAT

The budget and your business

· Reform of taxation on trusts to curtail its use to avoid tax. This includes aspects of local and offshore trusts, as well sa the use of trusts to avoid estate duty.

· Restricting debt to prevent the erosion of the tax base.

· A new Procurement Office has been established within National Treasury to restructure the government procurement system.

· New treatment for real estate investment funds.

· Hedge funds to fall under collective investment scheme legislation

· No details about the proposed mining tax

Budget facts and economic outlook:

· Total tax revenue for 2012/13 expected to be R16.3bn below estimate.

· Spending cuts of R10.4 bn over the next 3 years in response to tight fiscal conditions

· Budget deficit of 5.2% in 2012/13, 4.6% in 2013/14, 3.9% in 2014/15 and 3.1% in 2015/16.

· Total revenue: R887.8 bn in 2012/13, R985bn in 2013/14, R1091bn in 2014/15 and R1199bn in 2015/16.

· Total expenditure: R1055bn in 2012/13, R1149bn in 2013/14, R1244bn in 2014/15 and R1334bn in 2015/16

· The national treasury expects economic growth of 2.7% in 2013, 3.5% in 2014 and 3.8% in 2015.

· The national treasury expects CPI to remain within 3% and 6% over the next three years

Retirement and financial services reform announced in budget.

PRETORIA - If you save more, you will get more tax benefits. This is the message from the proposed retirement reform proposals by National Treasury contained in Wednesday’s Budget Review.

Times are tough. The economy is not growing as fast as some of the leading regions in the world and thus government revenue is under pressure with tax revenue for 2012/13 expected to be R16.3bn below the 2012 Budget estimate. In these tight circumstances finance minister Pravin Gordhan is urging South Africans to save more. South Africa is notorious for its low savings levels, which also makes investment difficult as foreign finances then need to be used as the local savings pool is not sufficient. And now the minister is trying to make it easier for South Africans to save.

A year after he indicated this need for South African households to save more, he today announced proposals for financial services and retirement reform in the 2013 Budget. These are still up for consultation as legislation will only be introduced later this year.

Although the implementation date for retirement savings reforms is not yet clear, the proposals include tax deductions for provident funds employee contributions and a uniform percentage of 27.5% of remuneration of taxable income (whichever one is greatest) for pension and provident fund contributions as well as retirement annuity contributions.

Previously employee contributions to pension funds and retirement annuities were tax deductible (7.5% of pensionable salary and 15% of non-pensionable salary respectively), while employer contributions to provident funds and pension funds were also tax deductible (depending on the contribution – a minimum of 10% up to 20%).

This was quite a complicated system with different allowed percentages and provident fund members who could not get a tax deduction on their own contribution. In his 2013 Budget Speech finance minister Pravin Gordhan announced that the tax treatment of all these funds will now be simplified and harmonized.

Detailed proposals for these changes is contained in a discussion document and after comments were received National Treasury highlights some of the changes that can come into existence on an implementation date in the future.

All employer contributions will now be seen as taxable fringe benefits in the hands of the individual, pushing up his or her remuneration or taxable income.

If you have a retirement annuity the current tax regime allows a tax deduction of up to 15% of your remuneration or taxable income. After the changes, this will be pushed up to 27.5% allowing you a quite sizeable tax deduction if you choose to contribute the maximum amount.

With the tax deduction benefit for provident fund members comes a change in the options available to you upon retirement. Previously provident fund members could take their whole benefit in a cash lump sum. Under the new proposals, if you are above 55 at the time of implementation, you will benefit from the tax deductions and will also be able to take the total benefit in a lump sum. If you are below 55, the amount you have in the fund at the date of implementation and that growth can be taken as a lump sum. You will get tax deductions on new contributions, but that amount and growth will now be dealt with the same as for pension funds or retirement annuities upon retirement where only a third can be taken as a lump sum and the rest has to be annuitized. To qualify for this benefit you have to stay in the provident fund that you were in at the time of implementation.

The mooted tax-preferred savings and investment accounts will be introduced in April 2015. All returns accrued within these accounts and any withdrawals will be exempt from tax. Previously there was a fear that with the advent of these accounts, Treasury would do away with tax-free interest-income annual thresholds. This is not going to happen, with these thresholds increasing one more time on 1 March 2013 from R33 000 to R34 500 for individuals over 65 and from R22 800 to R23 800 for those below 65. The thresholds will, however, not be adjusted for inflation in future years as the new tax-preferred savings and investment accounts will now be introduced. “The account would have an initial annual contribution limit of R30 000 and a lifetime limit of R500 000, to be increased regularly in line with inflation,” the 2013 Budget Review reads. Treasury is still in consultation with the financial services industry on how to implement the system and thus it is not clear whether existing savings and investment products would be able to be reclassified as tax-preferred. This could mean that there might be transfer costs involved if an individual wants to move his or her savings or investment over to these new vehicles.

In his speech Gordhan also addressed issues around the governance of retirement funds, announcing that governance reforms for these funds will be implemented, with measures in place to ensure trustees are trained once they have been appointed. “I intend to call up a conference of all trustees this year to take this process forward,” he said. “More competition will be promoted by allowing providers other than life offices to sell living annuities,” he added. "

REF : SPI

"The budget and your wallet:

· Personal income tax relief of R7 billion. The marginal tax rate remains 40% and is applicable to an taxable income of more than R638 000 per annum.

· Sin taxes: A packet of 20 cigarettes will cost 60c more, a 750 ml bottle of liquor (spirits) R3.60 more, a 340 ml can of beer 7.5c more and a 340 ml can of cider will cost 7.3c more. A 750 ml bottle of wine will cost 15c more.

· The national fuel levy to increase by 22.5c/l and the Road Accident Fund Levy by 8c/l . The tax on fuel will therefore increase by 30.5c/l.

· Tax treatment of contributions to pension, retirement annuity and provident funds to be harmonised.

· Phased implementation of carbon tax proposed. It will be implemented from 1 January 2015 and amount to R120 per ton of CO2

· New PAYE proposals for individuals with more than one source of income.

· No increase in VAT

The budget and your business

· Reform of taxation on trusts to curtail its use to avoid tax. This includes aspects of local and offshore trusts, as well sa the use of trusts to avoid estate duty.

· Restricting debt to prevent the erosion of the tax base.

· A new Procurement Office has been established within National Treasury to restructure the government procurement system.

· New treatment for real estate investment funds.

· Hedge funds to fall under collective investment scheme legislation

· No details about the proposed mining tax

Budget facts and economic outlook:

· Total tax revenue for 2012/13 expected to be R16.3bn below estimate.

· Spending cuts of R10.4 bn over the next 3 years in response to tight fiscal conditions

· Budget deficit of 5.2% in 2012/13, 4.6% in 2013/14, 3.9% in 2014/15 and 3.1% in 2015/16.

· Total revenue: R887.8 bn in 2012/13, R985bn in 2013/14, R1091bn in 2014/15 and R1199bn in 2015/16.

· Total expenditure: R1055bn in 2012/13, R1149bn in 2013/14, R1244bn in 2014/15 and R1334bn in 2015/16

· The national treasury expects economic growth of 2.7% in 2013, 3.5% in 2014 and 3.8% in 2015.

· The national treasury expects CPI to remain within 3% and 6% over the next three years

Retirement and financial services reform announced in budget.

PRETORIA - If you save more, you will get more tax benefits. This is the message from the proposed retirement reform proposals by National Treasury contained in Wednesday’s Budget Review.

Times are tough. The economy is not growing as fast as some of the leading regions in the world and thus government revenue is under pressure with tax revenue for 2012/13 expected to be R16.3bn below the 2012 Budget estimate. In these tight circumstances finance minister Pravin Gordhan is urging South Africans to save more. South Africa is notorious for its low savings levels, which also makes investment difficult as foreign finances then need to be used as the local savings pool is not sufficient. And now the minister is trying to make it easier for South Africans to save.

A year after he indicated this need for South African households to save more, he today announced proposals for financial services and retirement reform in the 2013 Budget. These are still up for consultation as legislation will only be introduced later this year.

Although the implementation date for retirement savings reforms is not yet clear, the proposals include tax deductions for provident funds employee contributions and a uniform percentage of 27.5% of remuneration of taxable income (whichever one is greatest) for pension and provident fund contributions as well as retirement annuity contributions.

Previously employee contributions to pension funds and retirement annuities were tax deductible (7.5% of pensionable salary and 15% of non-pensionable salary respectively), while employer contributions to provident funds and pension funds were also tax deductible (depending on the contribution – a minimum of 10% up to 20%).

This was quite a complicated system with different allowed percentages and provident fund members who could not get a tax deduction on their own contribution. In his 2013 Budget Speech finance minister Pravin Gordhan announced that the tax treatment of all these funds will now be simplified and harmonized.

Detailed proposals for these changes is contained in a discussion document and after comments were received National Treasury highlights some of the changes that can come into existence on an implementation date in the future.

All employer contributions will now be seen as taxable fringe benefits in the hands of the individual, pushing up his or her remuneration or taxable income.

If you have a retirement annuity the current tax regime allows a tax deduction of up to 15% of your remuneration or taxable income. After the changes, this will be pushed up to 27.5% allowing you a quite sizeable tax deduction if you choose to contribute the maximum amount.

With the tax deduction benefit for provident fund members comes a change in the options available to you upon retirement. Previously provident fund members could take their whole benefit in a cash lump sum. Under the new proposals, if you are above 55 at the time of implementation, you will benefit from the tax deductions and will also be able to take the total benefit in a lump sum. If you are below 55, the amount you have in the fund at the date of implementation and that growth can be taken as a lump sum. You will get tax deductions on new contributions, but that amount and growth will now be dealt with the same as for pension funds or retirement annuities upon retirement where only a third can be taken as a lump sum and the rest has to be annuitized. To qualify for this benefit you have to stay in the provident fund that you were in at the time of implementation.

The mooted tax-preferred savings and investment accounts will be introduced in April 2015. All returns accrued within these accounts and any withdrawals will be exempt from tax. Previously there was a fear that with the advent of these accounts, Treasury would do away with tax-free interest-income annual thresholds. This is not going to happen, with these thresholds increasing one more time on 1 March 2013 from R33 000 to R34 500 for individuals over 65 and from R22 800 to R23 800 for those below 65. The thresholds will, however, not be adjusted for inflation in future years as the new tax-preferred savings and investment accounts will now be introduced. “The account would have an initial annual contribution limit of R30 000 and a lifetime limit of R500 000, to be increased regularly in line with inflation,” the 2013 Budget Review reads. Treasury is still in consultation with the financial services industry on how to implement the system and thus it is not clear whether existing savings and investment products would be able to be reclassified as tax-preferred. This could mean that there might be transfer costs involved if an individual wants to move his or her savings or investment over to these new vehicles.

In his speech Gordhan also addressed issues around the governance of retirement funds, announcing that governance reforms for these funds will be implemented, with measures in place to ensure trustees are trained once they have been appointed. “I intend to call up a conference of all trustees this year to take this process forward,” he said. “More competition will be promoted by allowing providers other than life offices to sell living annuities,” he added. "

Thursday, 14 February 2013

German and French economies contract sharply

"BERLIN/PARIS – Europe’s two largest economies, Germany and France, both shrank markedly in the last three months of 2012, suggesting the eurozone has slipped deeper into recession and throwing a first quarter recovery for the bloc into doubt.

The German economy contracted by 0.6 per cent on the quarter, official data showed on Thursday, its worst performance since the global financial crisis was raging in 2009. France’s 0.3 per cent fall was also slightly worse than expectations.

Worryingly for Berlin, it was export performance – the motor of its economy – that did most of the damage.

“In the final quarter of 2012 exports of goods declined significantly more than imports of goods,” the German statistics office said in a statement.

Back revisions to the French figures showed its output fell by 0.1 per cent in each of the first and second quarters of 2012, meaning the country has already experienced one bout of recession in the past 12 months" REF : FT.com Best Regards

Steven

Steven Morris CA (SA)

Mobile: 083 943 1858

Fax: 086 671 2498

E-Mail: steven@global.co.za

Website: www.stevenmorris.co.za

The German economy contracted by 0.6 per cent on the quarter, official data showed on Thursday, its worst performance since the global financial crisis was raging in 2009. France’s 0.3 per cent fall was also slightly worse than expectations.

Worryingly for Berlin, it was export performance – the motor of its economy – that did most of the damage.

“In the final quarter of 2012 exports of goods declined significantly more than imports of goods,” the German statistics office said in a statement.

Back revisions to the French figures showed its output fell by 0.1 per cent in each of the first and second quarters of 2012, meaning the country has already experienced one bout of recession in the past 12 months" REF : FT.com Best Regards

Steven

Steven Morris CA (SA)

Mobile: 083 943 1858

Fax: 086 671 2498

E-Mail: steven@global.co.za

Website: www.stevenmorris.co.za

Wednesday, 13 February 2013

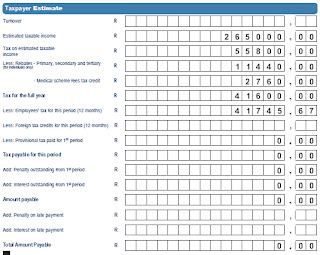

SARS : Provisional tax: Claim your medical tax credit

Author: Steven Jones, editor of Moneyweb’s Tax Breaks

13 February 2013 06:59 Provisional tax: Claim your medical tax credit

"How to ensure that your medical tax credit is taken into account when completing your provisional tax return.

QUESTION:

Being a provisional taxpayer and with the 28/02 deadline approaching, I am not sure whether or not to include the credit in my estimate for taxable income, or ignore it, i.e. should I deduct the amount I arrive at from taxable income or not ? SARS of course auto completes the line for rebates in efiling, so unless they make provision in their efiling IRP6 form for a new line specifically for medical credits claimed, I assume that my taxable income estimate should take account of the medical credit calculated as per those over 65 years ?

ANSWER:

The new IPR6 form on e-filing incorporates a provision for the medical tax credit. Once you have entered your estimated taxable income, the system calculates the tax liability as well as the primary / secondary / tertiary rebates based on your age as at the end of February 2013.

In the next line immediately below the rebates is a space for you to enter the tax credit. This you need to calculate manually as follows:

R230 per month for the taxpayer

R230 per month for the first dependent

R154 for each additional dependent

In the example below, the taxpayer is a single member with no dependents, therefore the medical tax credit is R2 760 (R230 x 12).

Finally, as was the case in previous years, enter any employees' tax deducted and provisional tax paid, and the system then calculates what you owe SARS. If your employees' / provisional tax exceeds the tax liability, the amount payable will be nil. In terms of the new SARS rules, if there is no liability you are not required to submit an IRP6, but seeing as you have got this far, it makes no difference if you click "file" other than the fact that having filed the return may give you peace of mind.

Don't forget to keep a copy of your workings, in case you need to prove to SARS that your estimate was reasonable and within the parameters stipulated."

If you have any queries please contact me.

Best Regards

Steven

Steven Morris CA (SA)

Mobie : 083 943 1858

Fax: 086 671 2498

E-Mail: steven@global.co.za

Website: www.stevenmorris.co.za

13 February 2013 06:59 Provisional tax: Claim your medical tax credit

"How to ensure that your medical tax credit is taken into account when completing your provisional tax return.

QUESTION:

Being a provisional taxpayer and with the 28/02 deadline approaching, I am not sure whether or not to include the credit in my estimate for taxable income, or ignore it, i.e. should I deduct the amount I arrive at from taxable income or not ? SARS of course auto completes the line for rebates in efiling, so unless they make provision in their efiling IRP6 form for a new line specifically for medical credits claimed, I assume that my taxable income estimate should take account of the medical credit calculated as per those over 65 years ?

ANSWER:

The new IPR6 form on e-filing incorporates a provision for the medical tax credit. Once you have entered your estimated taxable income, the system calculates the tax liability as well as the primary / secondary / tertiary rebates based on your age as at the end of February 2013.

In the next line immediately below the rebates is a space for you to enter the tax credit. This you need to calculate manually as follows:

R230 per month for the taxpayer

R230 per month for the first dependent

R154 for each additional dependent

In the example below, the taxpayer is a single member with no dependents, therefore the medical tax credit is R2 760 (R230 x 12).

Finally, as was the case in previous years, enter any employees' tax deducted and provisional tax paid, and the system then calculates what you owe SARS. If your employees' / provisional tax exceeds the tax liability, the amount payable will be nil. In terms of the new SARS rules, if there is no liability you are not required to submit an IRP6, but seeing as you have got this far, it makes no difference if you click "file" other than the fact that having filed the return may give you peace of mind.

Don't forget to keep a copy of your workings, in case you need to prove to SARS that your estimate was reasonable and within the parameters stipulated."

If you have any queries please contact me.

Best Regards

Steven

Steven Morris CA (SA)

Mobie : 083 943 1858

Fax: 086 671 2498

E-Mail: steven@global.co.za

Website: www.stevenmorris.co.za

Monday, 11 February 2013

Pope Benedict to step down, state news agency reports

Pope Benedict XVI will “leave the pontificate” at the end of February, the Italian state news agency Ansa reported on Monday

Best Regards

Steven

Steven Morris CA (SA)

Mobile: 083 943 1858

Fax: 086 671 2498

E-Mail: steven@global.co.za

Website: www.stevenmorris.co.za

Best Regards

Steven

Steven Morris CA (SA)

Mobile: 083 943 1858

Fax: 086 671 2498

E-Mail: steven@global.co.za

Website: www.stevenmorris.co.za

Subscribe to:

Comments (Atom)